Does Global Investing Still Makes Sense?

In 2014, the S&P 500 Index of the stocks of the 500 largest U.S. companies rose 14 percent. Outside the U.S. it was a different story: the MSCI Europe, Australasia, and Far East (EAFE®) Index of foreign stocks fell almost five percent and stocks in emerging markets lost about two percent. Over the past three years, the foreign stock returns are positive, but it’s basically the same pattern: global diversification has been a drag on your investment returns.

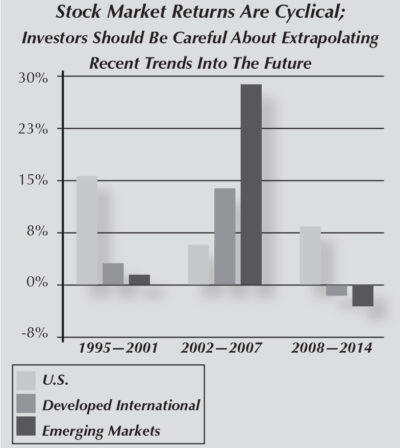

Naturally, when a pattern like this emerges, people begin to ask themselves whether diversification really makes sense. Looking back over the last three or five year periods, it’s hard to justify buying anything but the stocks of U.S. companies. But we’ve been there before, too. The graphic [above], compares investment results from 1995-2001 two following periods: 2002-2007 and 2008-2014.

Note how U.S. stock markets dominated the rest of the world, until they didn’t. A similar pattern emerges when you look at stock returns from 2008 – 2014; U.S. stocks dominate those of other countries.

My point is that market performance like this is cyclical, and very few people have demonstrated any ability to consistently predict which stocks (or indexes or even broad asset classes) will do better from one period to the next. Since nobody can say with confidence when a trend will reverse, investors need to be patient and stick with their long-term strategy.

So what should investors be doing? If you have a globally diversified portfolio, you should be buying, not selling, international investments today. Think about it: over the past several years, investments in Europe, Japan and even China have become significantly cheaper than investments in U.S. companies. This means that buying more U.S. stocks today is “buying high.” By comparison, the stocks of overseas companies are significantly cheaper (you are paying less today for tomorrow’s earnings) than are the stocks of U.S. companies.

It’s entirely possible that these stocks could get cheaper. And in some cases, Russia for instance, there may be good reasons why those stocks have sold off. Investing involves risks, and investing overseas adds additional risks like currency fluctuation and political risks. But the lower valuations on overseas stocks today means that markets have taken into account much of the higher risks and driven prices down already. If conditions improve in Europe or Japan and prices rise in the future, there could be better returns from the stocks of companies outside the U.S. than you could earn on similar U.S. companies.

One of the best ways to capture these changes is by periodically rebalancing your portfolio. For example, suppose you invest with a target of 45 percent U.S. stocks, 15 percent international stocks and 40 percent in U.S. bonds. At the end of last year, you might have more in U.S. stocks, which generally outperformed everything else, and less in international stocks, which lagged. Selling an investment that is up to purchase one that has lost money is HARD to do, but it is one of the critical investment disciplines which sets professional investors apart from the crowd. It is also one of the key factors contributing to studies which suggest professionals outperform individual investors by about four-to-five percent per year.

To answer the question I started with, think about how many products you own that were made by a company outside of the U.S. Do you own a Samsung TV, Toyota automobile, a Gucci bag or maybe a Mercedes? These are great companies that make great products, and if you don’t own international stocks in your portfolio, you may not be participating in the growth and profits that these companies can earn.

This column is prepared by Rick Brooks, CFA, CFP®. Brooks is vice president for Investment Management with Blankinship & Foster, LLC, a wealth advisory firm specializing in comprehensive financial planning and investment management. Brooks can be reached at (858) 755-5166, or by email at brooks@bfadvisers.com. Brooks and his family live in Mission Hills.

Category: Life Style