Rick Brooks

Rick Brooks's Latest Posts

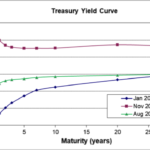

The First Horse of the Apocalypse?

There’s been a fair bit of media attention on the Treasury Yield Curve lately, so I thought I’d dig into that a bit this month. Investors look at a LOT of indicators to try to figure out where the economy and the stock markets are headed. There are several leading indicators that you can look […]

Getting Ready for Medicare

Medicare is the primary health insurance for U.S. citizens over 65. Unless you (or your spouse) are still working and covered by an employer-sponsored group health plan, all persons age 65 and older must sign up for Medicare to obtain health insurance. The Medicare rules are complex and can be confusing. It is important to […]

Social Security and Longevity

Every year, the Trustees for Social Security release a report which discusses the funding of the Social Security program. While it’s possible that Congress may enact changes to the Social Security program at some point in the future, we can’t predict how (or even if) that might take shape. With the caveat that there is […]

Roth Conversions: More Important Than Ever Before

A Roth Conversion is when you distribute money out of a regular IRA and “convert” it into a Roth IRA. Because you are taking a distribution from your IRA, this creates taxable income. If the funds are then left in the Roth IRA for five years or more (and you are over 59½), earnings in […]

The Two Best Tools for Understanding Your Finances

Have you ever looked at an empty toolbox and wondered what should be in there? What are the fundamental tools that a craftsman absolutely must have? For financial planners, two of the most important tools are a person’s balance sheet and cash flow statement. A quick review of these two documents can tell a lot […]

The Problem With Protectionism

On balance, global trade makes everyone better off. Trade lowers prices for domestic consumers and increases the choice and variety of goods available. Sixty-inch flat screen TVs would not be selling for $600 today without the increased availability and lower costs of global trade. So how do tariffs affect trade, and why is the stock […]

Trust, But Verify

Hiring a bookkeeper is an excellent way to help keep your finances organized, especially if you’re not that into managing money and balancing a checkbook. A bookkeeper who can keep track of income and pay bills is a valuable resource for a busy entrepreneur, enabling a business owner focus on his or her business instead […]

Two Ways To Keep Your Charitable Deductions in 2018

The Tax Cuts and Jobs Act of 2017 changed a lot about living in California. While the Standard Deduction doubled, personal exemptions were eliminated and several prominent deductions were capped or eliminated, including: • Deductions for state and local taxes (income, property, sales and other) are capped at $10,000. • The cap on new mortgage […]

Are We Worrying About The Right Things?

As we close out 2017 and start looking into the new year, several themes have been pervasive in our public discourse. As an investor, it’s important to look not just at the market results (which have been spectacular), but also the challenges facing us in the years to come. One thing that has struck me […]

Skilled Care Guidance

Have you ever had a loved one in a skilled nursing rehabilitation facility? This often follows a significant stay in the hospital and allows a patient to heal and strengthen under skilled care before coming home. Medicare will pay for the first 100 days (or so) of care in such a facility, but after that […]