Tag: Rick Brooks and Blankinship & Foster

Investing in the “New Normal”: Now what?

As I write this article, it appears that the current outbreak of the COVID-19 pandemic has peaked in most U.S. states. State and local lock-down orders are being eased, but it’s an open question as to what will pass for a new normal while the pandemic continues. Even as some states begin to open up, […]

Paying for College

A college education gives your child a significant advantage in today’s job market, generally delivering higher earnings throughout their entire working life. Over the years, Congress has introduced many different incentives to help families afford the cost. Here are several of the key incentives and how they can help with you with the rising cost […]

Have a Happier New Year

As a financial planner, my basic role is to help people make their lives better, whether it’s through realizing their dreams or simply organizing their finances. In more than 20 years of working with clients, I’ve found that the most impactful conversations are often not about money. They are about life, health and relationships. With […]

Charitable Gifting Today

The Tax Cuts and Jobs Act of 2017 eliminated or capped a lot of itemized deductions for most taxpayers. While deductions for charitable gifts were preserved, raising the standard deduction meant that many taxpayers lost the benefit of all but the largest donations. Here are some strategies that you can use to squeeze out the […]

Should I Buy or Lease My Next Car?

For some people, the decision whether to buy or lease a car is simply a matter of preference. But which is the better financial decision? To answer this, you must evaluate long-term cash flows and winnow out the (often hidden) costs. This can be difficult to do, especially when the salesman is tapping his finger […]

Turning Savings Into Income

One of the most common questions we hear from people preparing for retirement is, “How do I access my savings now that I won’t be working anymore?” It requires a bit of a shift in thinking, especially for those who’ve diligently saved funds into retirement and savings accounts. What you need is called a “Withdrawal […]

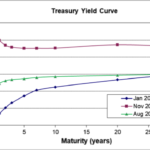

The First Horse of the Apocalypse?

There’s been a fair bit of media attention on the Treasury Yield Curve lately, so I thought I’d dig into that a bit this month. Investors look at a LOT of indicators to try to figure out where the economy and the stock markets are headed. There are several leading indicators that you can look […]

Getting Ready for Medicare

Medicare is the primary health insurance for U.S. citizens over 65. Unless you (or your spouse) are still working and covered by an employer-sponsored group health plan, all persons age 65 and older must sign up for Medicare to obtain health insurance. The Medicare rules are complex and can be confusing. It is important to […]

Social Security and Longevity

Every year, the Trustees for Social Security release a report which discusses the funding of the Social Security program. While it’s possible that Congress may enact changes to the Social Security program at some point in the future, we can’t predict how (or even if) that might take shape. With the caveat that there is […]

Trust, But Verify

Hiring a bookkeeper is an excellent way to help keep your finances organized, especially if you’re not that into managing money and balancing a checkbook. A bookkeeper who can keep track of income and pay bills is a valuable resource for a busy entrepreneur, enabling a business owner focus on his or her business instead […]