Bad News Good News on Foreclosures

I think we are all familiar with the BAD NEWS. As the first wave of foreclosures hit San Diego County, the reality probably struck fairly close to home with many neighbors, family members and associates losing their homes. San Diego Homeowners were witness to “Too good to be true” growth in property value that, of course, turned out to actually be “Too good to be true.”

The BAD NEWS continues as foreclosure rates really show no sign of slowing. The immediate impact of foreclosures is of course bad, but ultimately these homes need to be filled with economically-productive homeowners. In a few years many of the people that lost their homes will no doubt be home buyers again.

The GOOD NEWS is that Foreclosures in San Diego County are a huge investment opportunity, as we may have already the reached the proverbial bottom. In addition, interest rates are at all-time lows. It’s a simple formula: real estate is an equity-based investment and the time is right for a buy, improve and sell for a profit strategy.

San Diego Foreclosures – for the savvy investor it is the perfect storm.

San Diego Foreclosures – for the savvy investor it is the perfect storm.

San Diego is a great town and an economically productive one. It’s not a question of “if,” it really is a question of “when” things will turn around. We predict about a 2-3 year window of opportunity to invest.

You will see a lot of “Do it Yourself” seminars advertised, and while these are great resources for information, the investor still has to go through the process of looking, tracking, handling paperwork, and performing due diligence. If the investor has time to do that, great. However, there is an entire category of would-be investors that have a life, a job and other business commitments.

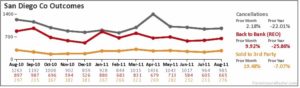

That’s where our company Smart Real Estate Foreclosures comes in. In San Diego at this time there are roughly 1400 properties being sold at auction every month. What our company does is find the right properties that have the most “upside” and connect those properties with like-minded investors.

We represent the investors at auctions identifying the top investor picks. If you wonder if we buy properties ourselves, the answer is absolutely. We actually used bid services in the past ourselves in Arizona and California and realized there was a need for a premium boutique service that uses technology in a strategic way. Thanks to the Internet, we can send immediate picture and video updates to cell phones, iPads and computers so that our clients are literally sitting at the breakfast table while making a deal happen.

These articles and blog posts will be dedicated to keeping our readers up to date on our adventures, the current opportunities and changes in the market place. It’s a unique time in real estate, as we are at the bottom where most fortunes are made. This is the time that many of us will tell our grandchildren about.

Alan Kinzel is Founder of Real Estate Auction Angels, Inc., and its California sister company Smart Real Estate Foreclosures, based out of San Diego, California. He received undergraduate degrees in Finance and Economics from the University of Missouri, Columbia, and went on to earn his MBA from the University of Illinois at Urbana-Champaign. After a successful career at PepsiCo’s Frito-Lay division, Kinzel went on to found USA Mortgage and LoanSurfer.com, one of the pioneers for Internet mortgage originations. As CEO of LoanSurfer.com he received recognition for technology innovation, and the company received numerous awards for it’s innovative website that introduced many concepts still used by mortgage origination sites today.

Visit PresidioSentinel.com for updates from the field. Visit SmartRealEstateForeclosures.com and RealEstateAuctionAngels.com for more information and call 619-702-7266.

Category: Business