Tag: Rick Brooks

Retirement Planning Isn’t a One-Time Project: Here’s Why You Need Ongoing Support

When it comes to preparing for retirement, many people think of it as a box to check off. You meet with a financial advisor, create a plan, and then you’re done—right? Not quite. Retirement planning isn’t a one-time project. It’s an ongoing process that needs adjusting as your life, the markets, and your priorities evolve. […]

Auto Insurance and Delivery Driving

Delivery driving, whether for pizza shops or gig platforms, involves unique insurance risks that most personal auto policies do not cover. Personal use auto insurance typically will not cover business use of a car for things like delivering pizzas. Commercial auto insurance is required for anyone using their vehicle for business purposes, including food delivery. […]

Nine Important Retirement Milestones (Starting at Age 50)

I’m continuing the topic of properly preparing for retirement this month. Most people don’t really start thinking about retirement at age 50, but there are a few things you should be doing to set yourself up early for a comfortable and secure retirement. Age 50: Catch-Up Contributions Begin At age 50, you can start making […]

When to Make a Homeowners Insurance Claim: A Comprehensive Guide

Filing a homeowners insurance claim is a critical decision that requires careful consideration. While insurance is designed to protect you financially in times of need, not every incident warrants a claim. Understanding when to file can save you money, preserve your claims history, and ensure you’re making the most of your coverage. Assessing the Situation […]

Taking Over Your Parents’ Finances

I can state from first-hand experience that taking over your parents’ finances can be a challenging and sensitive process. As parents age, they may need help managing their money and bills. This can be especially true if cognitive impairment is occurring. But this transition often comes with complex issues that adult children must navigate carefully. […]

Six Common Mistakes Trustees Make

Planning for the distribution of your estate is complex. There are so many variables to consider, like family dynamics, changing values and ever-changing tax rules. It can be easy to simply ignore the planning, but that just leaves your heirs to clean up a huge mess and often causes strife trying to figure out what […]

Your Car is Watching You

By Rick Brooks Have you read the terms and conditions of the applications installed on your car? Or your phone, for that matter, but let’s focus on your car for now. A couple of weeks ago, Kashmir Hill at the “New York Times” reported that users of General Motors OnStar services (including myBuick, myGMC, myChevrolet […]

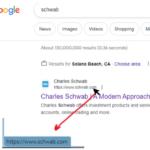

SEO Scams Can Lead You Astray

As if there wasn’t enough to worry about online, another scam has become increasingly common and a growing concern for financial institutions. SEO scams hijack your search results and take you to websites that look like familiar (especially financial institutions) sites but aren’t. For example, Charles Schwab recently notified advisors who work with them that […]

What to Look for in your Annual Life Insurance Review

Seriously, when is the last time you reviewed your life insurance? I don’t mean the letter you get (and probably throw away) from your insurance agent every year asking if you need more. I mean really sitting down and thinking about the life insurance you have, why you have it and what you are paying […]