Tag: Rick Brooks

The “R” Word: Recession

It’s been more than ten years since the end of the last recession, which is one of the reasons people have been talking about it lately. Historically, recessions come along every five to seven years, and so by that measure, we’re overdue for one. On the other hand, forecasts of when the next recession will […]

Investing In Real Estate 2: How Not To Invest In Real Estate

Last month, I discussed some of the benefits of including real estate in your investment mix. These include income, diversification and, in the case of owning property directly, some significant tax advantages for owning income properties. I also mentioned that there are some versions of real estate investing which are more attractive than others. A […]

Should I Retire in A Lower Tax State?

When considering how to plan for a comfortable retirement, taxes are a significant consideration. Taxes of all types are among the largest contributors to your cost of living during retirement, and cost of living can make the difference between a comfortable retirement and a meager one. What’s more, high state and local taxes have been […]

On Valentines Day, Give your Spouse the Gift of Security

Valentine’s Day is the third-largest consumer holiday in the U.S., with about 19 billion dollars spent in Cupid’s name each year. It’s big business for florists and chocolatiers, with over four billion dollars spent per year on flowers and candy alone. Flowers and candy are great, don’t get me wrong, but as a gift for […]

Keeping Track of Multiple IRAs

Besides losing weight and getting in shape, one of the more common New Years’ resolutions is getting organized. It’s also one of the first steps in the financial planning process because it makes keeping on top of your finances a lot easier. Nowhere is that more important than with your retirement savings. This is because […]

Creating Your Best Retirement Isn’t All About Money

A 2014 study of retirees done by Merrill Lynch and Age Wave led to the following conclusion: “Retirees say health is the number one ingredient for a happy retirement.” Financial security, family and purpose were all important, but health was tops. And this makes perfect sense, as good health leads to living longer, having more […]

Common IRA Mistakes in Retirement and How to Avoid Them

The most common IRA mistakes made in retirement are easy to avoid. Most come from not understanding the complex rules surrounding Individual Retirement Accounts (IRAs). Others come from trying to game those rules to avoid paying taxes. As tempting as it might be to try to avoid paying taxes on retirement savings distributions, breaking the […]

Protecting Your Travel Investment

A lot of Baby Boomers have been retiring recently, and a good many of them have spent that extra time travelling. For some, that has meant hopping in a recreational vehicle and roaming the highways and byways of the Continental United States. For others, that has meant jetting off to destinations they didn’t have time […]

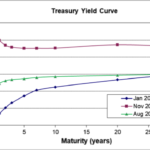

The First Horse of the Apocalypse?

There’s been a fair bit of media attention on the Treasury Yield Curve lately, so I thought I’d dig into that a bit this month. Investors look at a LOT of indicators to try to figure out where the economy and the stock markets are headed. There are several leading indicators that you can look […]

Getting Ready for Medicare

Medicare is the primary health insurance for U.S. citizens over 65. Unless you (or your spouse) are still working and covered by an employer-sponsored group health plan, all persons age 65 and older must sign up for Medicare to obtain health insurance. The Medicare rules are complex and can be confusing. It is important to […]