Tag: Rick Brooks

Protecting Your Identity in a “Mega-Breach” World

The following article was written by my business partner, Jon Beyrer, CFP, EA. With the announcement a few weeks ago by Anthem Blue Cross, and a disclosure recently that Lenovo has been pre-installing malware on computers they sold, it seems we are going to have to become much more vigilant about our personal information. Anthem […]

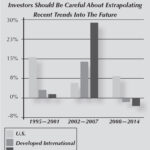

Does Global Investing Still Makes Sense?

In 2014, the S&P 500 Index of the stocks of the 500 largest U.S. companies rose 14 percent. Outside the U.S. it was a different story: the MSCI Europe, Australasia, and Far East (EAFE®) Index of foreign stocks fell almost five percent and stocks in emerging markets lost about two percent. Over the past three […]

Retirement Accounts: Trusts as Beneficiaries

I hope you’ve enjoyed the holidays. As we ring in the New Year and start our client review cycle, one of the things that we do for our clients is to review the beneficiary designations of their retirement accounts (pensions, IRAs, etc.). This is important because the beneficiary designations that you elect control who gets […]

Retirement Accounts: Distribution Rules

With the year-end approaching, an important deadline for retirement account owners is also coming, so this column will deal with some of the rules surrounding IRAs and distributions. A significant caveat applies here: the rules can be very complex and people have literally written books on the topic. So I won’t be able to cover […]

Tax Efficient Charitable Giving

A couple of months ago, I wrote about having a charitable giving plan, and how that can allow people to be strategic about their charitable gifts. As tax rates have been on the rise lately, many people have been looking for ways to reduce their income tax bill while benefitting the community. The whole point […]

Charitable Giving is on the Rise

By Rick Brooks According to a report by Giving USA, gifts to charity totaled $335.2 billion last year, up 4.4 percent from 2012 and almost back to the peak levels reached in 2007. I’ve also had the pleasure of being able to assist some very generous clients with their personal gifts recently, so I thought […]

Saving for College

According to a 2011 report by the Census Bureau, a college graduate can earn over 80 percent more during his or her lifetime than someone with just a high school diploma. But that advantage comes with a price tag. Currently, the annual cost of a four year private college can top $30,000 for tuition, fees, […]

Extra Crispy

By now, it can’t come as a surprise to San Diegans that California is facing one of the worst droughts in recorded history, and according to one report, maybe the worst since 1580. In a recent interview on KPBS, CAL FIRE San Diego Deputy Chief Kelly Zombro stated that local brush moisture levels are at […]

Tax Efficient Investing, Part I

For the first time in over a decade, tax rates on income and investment gains have risen. In addition, a new Net Investment Income tax has been imposed on all investment income for taxpayers whose Adjusted Gross Income (AGI) is above certain thresholds ($200,000 for single filers and $250,000 for married filers). So, given these […]