Tag: Rick Brooks

Financial Planning for a Younger Spouse

I’ve worked with several couples with very different birthdates. This isn’t good or bad – as they say, the heart wants what it wants. Still, the financial planning considerations are a little different than for people who marry someone closer to their own age. So, here are five things to think about when a couple’s […]

Five Questions People (Almost) Never Ask Their Advisor

I meet with a lot of people who are looking for financial advice. Their needs and financial knowledge vary greatly. And yet, it amazes me how rarely I am ever asked five simple, straightforward and utterly critical questions, which will go a LONG way towards helping you differentiate good advisors from salespeople. Each of these […]

Blankinship & Foster CIO Leads Girl Scouts Board

Blankinship & Foster, a nationally recognized wealth advisory firm in Solana Beach, California, announced that its Chief Investment Officer, Rick Brooks, has been elected chairman of the board of directors of Girl Scouts San Diego. Brooks’ tenure officially began January 5, just in time for the start of the annual Girl Scouts Cookie Program on […]

Protecting Your Identity in a “Mega-Breach” World

The following article was written by my business partner, Jon Beyrer, CFP, EA. With the announcement a few weeks ago by Anthem Blue Cross, and a disclosure recently that Lenovo has been pre-installing malware on computers they sold, it seems we are going to have to become much more vigilant about our personal information. Anthem […]

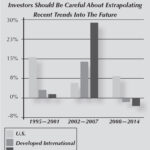

Does Global Investing Still Makes Sense?

In 2014, the S&P 500 Index of the stocks of the 500 largest U.S. companies rose 14 percent. Outside the U.S. it was a different story: the MSCI Europe, Australasia, and Far East (EAFE®) Index of foreign stocks fell almost five percent and stocks in emerging markets lost about two percent. Over the past three […]

Retirement Accounts: Trusts as Beneficiaries

I hope you’ve enjoyed the holidays. As we ring in the New Year and start our client review cycle, one of the things that we do for our clients is to review the beneficiary designations of their retirement accounts (pensions, IRAs, etc.). This is important because the beneficiary designations that you elect control who gets […]

Retirement Accounts: Distribution Rules

With the year-end approaching, an important deadline for retirement account owners is also coming, so this column will deal with some of the rules surrounding IRAs and distributions. A significant caveat applies here: the rules can be very complex and people have literally written books on the topic. So I won’t be able to cover […]

Tax Efficient Charitable Giving

A couple of months ago, I wrote about having a charitable giving plan, and how that can allow people to be strategic about their charitable gifts. As tax rates have been on the rise lately, many people have been looking for ways to reduce their income tax bill while benefitting the community. The whole point […]

Charitable Giving is on the Rise

By Rick Brooks According to a report by Giving USA, gifts to charity totaled $335.2 billion last year, up 4.4 percent from 2012 and almost back to the peak levels reached in 2007. I’ve also had the pleasure of being able to assist some very generous clients with their personal gifts recently, so I thought […]